PROGRESSIVE GROCER: Post-Frequent Shopper Card: What’s the Next Disruptive Force?

Cynthia Keating and Nicole Dvorak

“The card isn’t so special anymore…”

Six simple words from Jewel’s recent announcement that it was canceling its frequent shopper card program spoke volumes on the future of the card-based loyalty industry. Regardless of whether this will be an isolated example or the beginning of a trend, it is clear that frequent shopper cards are no longer considered a universal vehicle to capture and promote consumer loyalty. This is a harbinger of the force that will gain increasing importance over the next few years — the emergence of the shopping app.

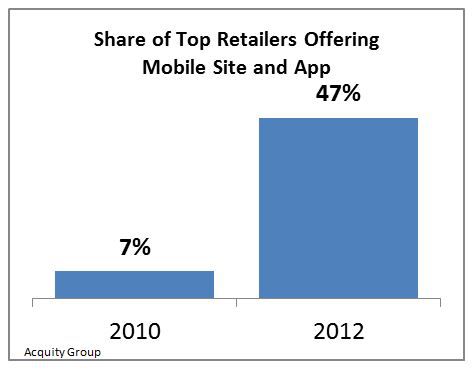

Although still in early stage development, the next incarnation of frequent shopper cards comes in the form of apps delivered on smart phones. Retailers offering mobile apps grew by almost five-fold to slightly less than half of top retailers from 2010 to 2012 . These apps encourage all types of convenient, incentivized activities, but are not solely driven by the desire for rewards. Specifically, common features of these apps include shopping lists and discounts at the point-of-sale, regardless of shopping venue. They can also enable faster checkout, ease of navigation through the store, and personalized recommendations based on past purchases, each of which match or exceed benefits of retailer frequent shopper card programs.

When executed well, frequent shopper cards (and shopping apps) foster consumer loyalty to retailers, creating valuable shoppers that disseminate a positive image of the retailer to the community. Retailers who have succeeded most with frequent shopper cards include many of the first movers in the industry like Wegmans, CVS, and Stop & Shop, who lead the industry in their ability to offer personalized rewards and discounts, while transcending the natural retailer reflex to use frequent shopper card programs exclusively for discounts. The CVS ExtraCare Loyalty Program, for example, uses personalized programs that increase shopper loyalty including coupons that reflect previous purchase history and print out at the bottom of the receipt. Wegman’s loyalty program is unique in that it enables shoppers to make purchases wallet-free by linking their checking account to their loyalty card. Ahold USA’s Stop & Shop shoppers use their loyalty card to activate an in-store scanner to scan and bag their own groceries as they navigate the aisles, allowing them to cruise through the checkout line.

For retailers who have stopped supporting or have never had frequent shopper card programs, the most important element of the new app-driven shopper programs is that they appeal to Millennials. Shopper-driven apps can be a fundamental way of reaching this elusive, app-savvy cohort. Early entries include Shopkick, Grocery IQ and Out of Milk, among others. While these apps and the corresponding rewards they provide are not served up as loyalty or frequent shopper card programs, they serve the same purpose.

A powerful aspect of app-driven loyalty programs is the amount of data that can be collected across channels and on purchases. Participants who opt in for the program provide valuable information to CPG companies and retailers in return for special offers or convenience. Combining users’ profiles with purchase behavior can reveal hidden trends within certain shopper types or identify gaps versus the average U.S. shopper. Data acquired through these apps can supplement, or even replace, conventional point-of-sale or shopper loyalty card data.

Retailer-agnostic apps have the greatest potential to provide a much broader picture of consumer purchase behavior. Apps like AnyList allow users to pull ingredients onto a grocery list directly from online recipes. Ibotta recently secured a spot behind Pinterest as the most frequently used app on a mobile phone and touts cash rewards instead of coupons when users purchase specific items. Ibotta has the potential to substantially influence purchase decisions because consumers watch campaign videos, answer polls or post to Facebook or Twitter regarding purchases. If Ibotta is successful in its ability to influence shopping decisions at the point of sale, it will create a sea change in consumer influence marketing. Shopkick is a popular app that reminds consumers to make purchases and rewards them with gift cards, song downloads and other low-end goods.

With connections to social media that can be shared with others, app-driven loyalty programs can be extended in a way that retailer frequent shopper cards cannot. Manufacturers not already partnering with top shopping apps are falling behind, foregoing an opportunity to improve branding or reach a narrowly defined consumer segment. The time to participate is now. Becoming part of the app world is a three-step process.

First: Manufactures should assess which brands are most suited for app-influenced behavior.

Second: They need to understand and target shopper they are hoping to influence.

Third: They must explore and prioritize the apps best suited to meet these needs.

Consumer loyalty will continue to be actively pursued by retailers and CPG manufacturers. The new wave of app-driven tools is the next important leg of this journey. The winners and losers in this game will be those who can adapt quickly and recognize the value of the disruptive new technology as it evolves.