PROGRESSIVE GROCER: Disruptive Pricing: A New Approach for New Challenges

Jack Ryder and Jumbo Zhang

If you ask most consumer products executives what their single biggest issue is today, they will universally answer “pricing.” The lack of pricing leverage in today’s low-inflation environment has forced manufacturers and retailers to examine every part of their business portfolio to find savings to meet bottom line needs.

With high unemployment and under-employment and no near-term end to low inflation, any type of pricing action will be challenging. Unfortunately. the situation is made more complicated when pricing of commodities continues to increase.

This economic context easily could lead manufacturers to believe that they have no latitude with pricing — particularly price increases. This conclusion would be incorrect. With the current stable price environment, now is the time for manufacturers to thoroughly assess portfolio pricing as they re-evaluate their go-to market strategies.

Often, product pricing decisions are made in the same way that rooms are added to a house. Pricing is evaluated on an ad hoc basis and bolted on to an existing pricing infrastructure. As a result, go-to market strategies and pricing for an entire product portfolio can be inconsistent and complicated. Strategies end up emphasizing the need for higher margin or more velocity on just a few items rather than creating a coherent strategy across the total manufacturer portfolio.

Pricing strategies and tactics are facing a disruptive and fundamental change.

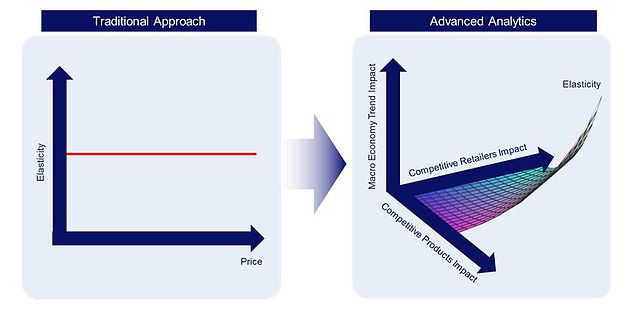

Today, with the proliferation of new channels and mobile apps, shoppers are able to compare the price between products in a given consideration set and even across retailers or channels, resulting in a constantly changing demand elasticity. Traditional methods of regression analysis and price sensitivity evaluation are no longer adequate to thoroughly understand the dynamic pricing environment that exists today.

With the availability of very granular data — reflecting the purchases of millions of shoppers on millions of occasions with a host of differing pricing scenarios — it is possible to measure the influence a range of pricing factors has on the purchase decisions that shoppers make. More advanced pricing analysis takes into consideration factors that continually influence the consumer’s purchase decision in ways that were not possible even five years ago.

Three-dimensional pricing modeling, including consumer, competitor and customer dynamics is the solution to portfolio pricing today. An advanced dynamic pricing model creates a constantly changing elasticity to reflect the dynamic market place by using three dimensions of price factors. This more advanced modeling technique is significantly more accurate and robust than the traditional approach. Unlike traditional pricing approaches and tools, the new method can link all the products together through cross-elasticity, trade budget and total sales and/or profit contribution. The result is a comprehensive optimization that provides alignment across the portfolio to maximize total business profitability.

Given the depth of data within the model, the analysis and supporting tools can be used to support a wide range of business decisions, such as to simulate optimized weekly promotion activities, which provide huge benefits to the manufacturers who only plan to optimize pricing at certain periods of time, like holiday seasons. Manufacturers who have used this model have redefined product roles, pricing strategies and provided execution-ready strategic recommendations for greater effectiveness.

In one trade strategy example, a full portfolio pricing analysis using the three-dimensional pricing approach was conducted for a CPG manufacturer which helped identify the investment opportunity and trade funds sources within the portfolio without sacrificing promotion performance. As a result of this move, the CPG manufacturer gained more than 5 percent profit growth in the same year and another 7 percent in the following year.

Another CPG manufacturer also used the three-dimensional pricing analysis to diagnose its current pricing strategy limitations relative to its key competitor. The new advanced approach provided a new way to review the price strategy internally and helped to redefine the product marketing role within the portfolio across different channels. The manufacturer was able to adjust everyday pricing within the total U.S. product portfolio and create different promotion price strategies for different retailers based on the level of competition. Retailers were willing to implement the new changes, helping the manufacturer establish a leading position in the category.

Conventional wisdom indicates that retailers do not expect, nor in some cases, will they accept price increases from manufacturers in this low-inflation environment. Fortunately, pricing actions executed using the new approach are more akin to price adjustments than to traditional pricing moves in the historical sense of increases and decreases. More importantly, the onset of a new analytical pricing regimen makes pricing action possible.

Given the current environment, and based on recent successes using three-dimensional modeling, manufacturers cannot afford to overlook this fundamental element of the marketing mix, and cannot justify inactivity due to market conditions.

The upside opportunity is significant. To begin, consider three steps:

Assess the current product price portfolio and determine the consistency (or lack of consistency) of the plan.

Identify functions that can assist in the new pricing analysis taking into consideration the three-dimensional nature of pricing analysis using big data sources.

Begin a pilot with one or two brands to pressure test the concept and the potential outcomes of the new pricing regimen.

Negotiation on pricing is never an easy conversation. Given the demands of today’s environment, understanding the price sensitivity across consumer, competitor and customer is absolutely essential to take advantage of every opportunity to gain margin in low-inflationary times.