Middle Market Growth: The Digital Dilemma: Are online ads living up to the hype for midmarket e-commerce companies?

Social and streaming media services would seem to be every advertiser’s dream, offering the ability to target the ideal prospective customer. But their effectiveness depends on what you sell, how you sell it and to whom.

Small and midmarket e-commerce companies in specific niches, for example, are finding certain channels ideal. Larger companies that rely mainly on brick-and-mortar retail stores, not so much.

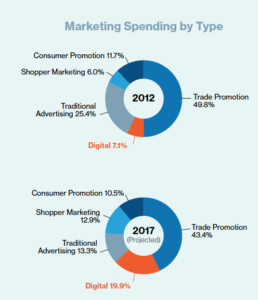

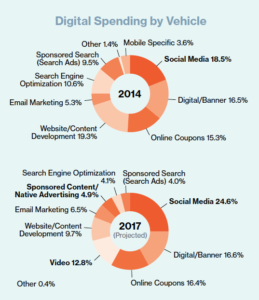

Spending on digital advertising is growing quickly. Internet advertising revenue in the United States totaled $72.5 billion in 2016, up nearly 22 percent over 2015, according to a report last year by PwC and the Interactive Advertising Bureau. A separate 2017 survey by Cadent Consulting Group, which works with retail and consumer packaged goods companies, reports that digital ads make up nearly 20 percent of marketing spending, nearly triple that of five years ago.

Companies love digital advertising’s ability to reach specific audiences. On Facebook, for example, an advertiser can target women between the ages of 30 and 40 who live in a particular zip code and buy organic produce.

But even with online advertising’s precision, the medium has limitations, and marketers are unsure of the ads’ return on investment. In the Cadent survey, digital received the lowest effectiveness rating by retailers and the lowest awareness and impact ratings by shoppers.

“With all of digital’s promise, and despite Facebook and Google telling you they know beyond a shadow of a doubt what makes people purchase, they really don’t,” says Ken Harris, managing partner at Cadent.